Choose Early FinOps Adoption

Why Early FinOps Adoption Is Your Cloud's Best Friend

The $100K Wake-Up Call

"I thought we had it under control," Sarah, a CTO at a rapidly growing SaaS company, told me last week. Her voice carried that all-too-familiar mix of frustration and resignation. Their cloud bill had just hit $100K – triple what they'd budgeted for the quarter. "If only we'd implemented FinOps when we first moved to the cloud..."

Sarah's story isn't unique. In fact, it's becoming the norm as companies rush to the cloud without proper financial governance. According to Gartner, through 2024, 60% of infrastructure and operations leaders will encounter public cloud cost overruns that will negatively impact their on-premises budgets.

The Early Bird Catches the Savings

Think of FinOps like a financial GPS for your cloud journey. Would you start a cross-country road trip without a map and then try to figure out your route halfway through? That's essentially what companies do when they delay FinOps adoption.

Early FinOps adoption isn't just about cost savings – it's about building a culture of financial accountability from day one. When engineering teams understand the cost implications of their architectural decisions from the start, they make fundamentally different choices.

The Real Cost of Delay

Let me share another story. A fintech startup I advised waited until they hit $100K in monthly cloud spend before implementing FinOps. During our first assessment, we discovered they were spending $20K monthly on idle resources – resources that had been quietly accumulating for months. That's $240K annually, straight down the drain.

"If we had these insights six months ago," their lead architect admitted, "we would have designed our auto-scaling policies completely differently. Redesigning now is like trying to change the engine while the car is running."

The Three Pillars of Early FinOps Success

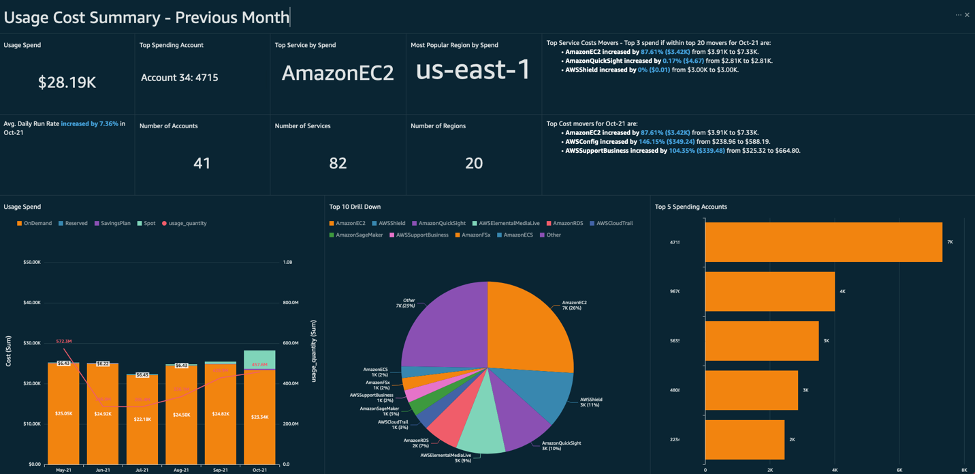

1. Visibility First: You can't optimize what you can't see. Early FinOps implementation gives you granular visibility into your cloud spend from day one. One of my clients reduced their development environment costs by 40% in their first month just by having proper tagging and allocation visibility.

2. Culture of Accountability: When developers understand that the cloud isn't a magical unlimited resource, they write different code. I've seen teams voluntarily optimize their applications after seeing the real-time cost impact of their deployment choices.

3. Automated Governance: Setting up automated policies early means you'll never wake up to a surprise bill. One healthcare startup avoided a potential $50K overrun when their automated alerts caught a misconfigured Kubernetes cluster before it could spiral out of control.

Making the Shift

The beauty of early FinOps adoption is that you can start small and scale up. Begin with basic tagging policies and spending alerts. Graduate to automated reporting and optimization recommendations. Eventually, build toward full programmatic financial operations that align perfectly with your business objectives.

Remember: Every month you delay FinOps implementation is another month of potential waste and missed optimization opportunities. As the old Chinese proverb goes, "The best time to plant a tree was 20 years ago. The second best time is now." The same applies to FinOps – the best time to implement was when you first moved to the cloud. The second best time is today.